|

| LFP |

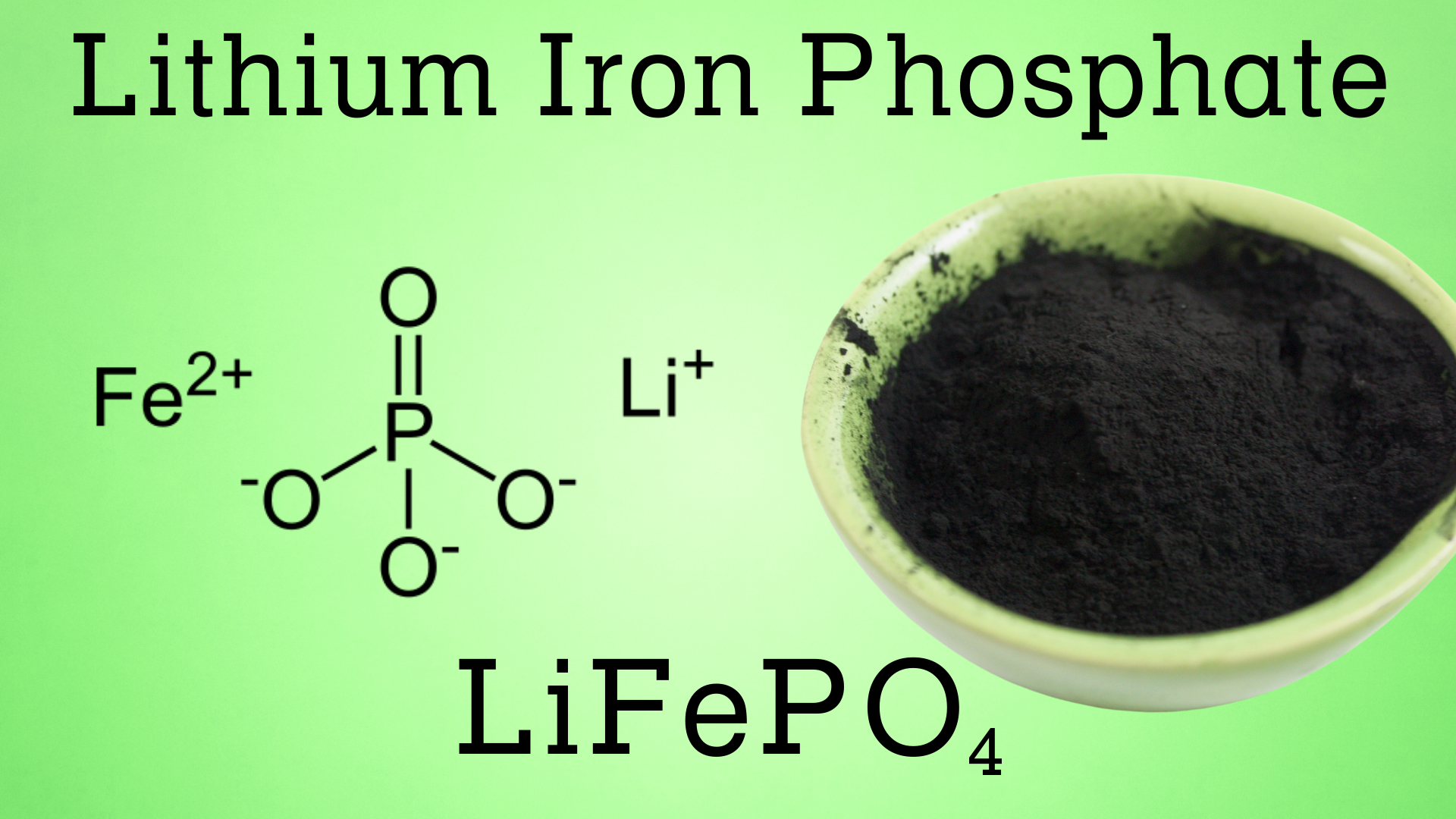

The race for dominance in the lithium iron phosphate (LFP) battery market is heating up as South Korea’s battery manufacturers aggressively challenge China’s longstanding leadership. LG Energy Solution (LGES), Samsung SDI, and SK On aim to roll out mass production of LFP batteries by late 2025, targeting the booming electric vehicle (EV) market.

South Korea’s Strategic Expansion

South Korean firms are not only competing on technology but also strategically targeting markets in the US and Europe, where Chinese manufacturers have faced challenges. The failure of Northvolt in Europe has opened a significant gap in regional battery production capacity, creating opportunities for South Korean entrants. However, the potential rollback of the US Inflation Reduction Act (IRA) tax credits under the Trump administration could pose financial hurdles for South Korean firms, complicating their expansion into the US market.

Regional Developments and Challenges

Australia: Focused on stationary storage batteries, Australia faces challenges in its nickel and lithium mining sectors. Setbacks like the closure of the Bald Hill site have spurred government intervention to stabilize the industry.

Indonesia and the Philippines: Southeast Asia is emerging as a competitive hub. Indonesia, in collaboration with LGES and Hyundai Motor, has launched a new battery facility. Similarly, the Philippines inaugurated its first LFP battery plant in October 2024, supported by Australian firm StB Capital Partners.

The competition in Asia’s battery market reflects the region’s growing importance in shaping global energy storage solutions, with players across nations vying for leadership in LFP technology.

Tags

POWDER